1.1 Political and geographical characteristics of Gambia

The Gambia gained independence from the United Kingdom in 1965. Geographically surrounded by Senegal, it formed a short-lived Confederation of Senegambia between 1982 and 1989. In 1991, the two nations signed a friendship and cooperation treaty, although tensions flared intermittently during Yahya JAMMEH's regime. JAMMEH led a military coup in 1994 which overthrew the President and banned all political activity. The President is elected directly by a simple absolute majority, 2 rounds popular vote if necessary for a 5 year term (no term limit). The last election took place in December 2016 and the next will be held in 2021.

- Area : 11,300 km2

- Population growth : 1,99%

- Population : 2,092,731 (July 2018)

- Urban population : 61,3% (2018)

- Density : 185 inhabitants/km2

- Official language : English

The Gambia is a member of ECOWAS, along with Benin, Burkina Faso, Cape Verde, Ivory Coast, Ghana, Guinea, Guinea-Bissau, Liberia, Mali, Niger, Nigeria, Senegal, Sierra Leone and Togo. It is also a member of the West African Monetary Zone along with Guinea, Ghana, Nigeria and Sierra Leone.

1.2 Macroeconomic framework

| Classement Doing Business | 149th/190 |

| Note CPIA (policy and institutional assessment) | 3,0 World Bank classification |

| GDP per capita (2017) | 708 $ |

| Growth rates | 4,6% (2017 est.) |

| Inflation | 8 (2017 est.) |

Sources : https://www.cia.gov – http://documents.worldbank.org

Main exports

Groundnut products, fish, palm kernels

Human Development and Infrastructure

65,4 years old

Life experience (2018)

48,4%

Poverty line population

94,2%

(total population) Access to water

58,4/1000

(2018 est.) Infant mortality

50,2

Distribution of family income GNI coefficient

36%

Access to electricity

14.4%

Malnutrition (total population)

55,5%

Adult literacy

134%

Cell phone access

1.3 Gambia economic performance and outlook

Macroeconomic performance

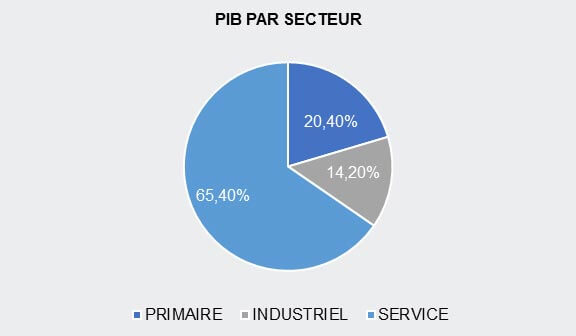

With confidence returning after the sharp slowdown in 2016, the economic recovery is being confirmed with a real GDP growth rate of 5.4% in 2018, higher than the 3.5% in 2017. Growth is mainly driven by services - tourism, business and financial services and insurance - which grew by 10% in 2018, coupled with solid growth in the transport, construction and telecommunications sectors. In tourism, 225,000 visitors were expected in 2018, following 2017's record of 171,000, which exceeded pre-Ebola figures.

In 2018, the budget deficit was close to 3.9% of GDP, compared with 7.9% in 2017, thanks to improved fiscal discipline and support from the international community. However, the public debt ratio was around 130% of GDP in 2017, and the country is classified as over-indebted. In 2018, inflation fell to 6.2% from 8% in 2017. Gross international reserves rose to 3.1 months in 2018 from 2.9 months in 2017, thanks to greater financial support from development partners.

The current account deficit remains high at around 19% of GDP in 2018, down slightly on 2017. During the first half of 2018, total imports increased by 9.2% compared to the first half of 2017, while total exports increased by 8.5% to USD 54.9 million. Exports consist mainly of commodities, including groundnuts (55.6%), fish and fishery products (21.6%) and cashew nuts (10.6%). The short-term economic outlook is expected to improve gradually over the medium term. Real GDP is expected to grow by 5.4% in 2019 and 5.2% in 2020.

Outlook: positive and negative factors

Insecurity and political instability pose risks for 2019, with the withdrawal of the Economic Community of West African States mission and possible conflicts linked to the three-year presidential term limit. In addition, high public debt will continue to put a strain on government spending in key socio-economic sectors such as health, education and infrastructure development, unless the country restructures its debt.

Other difficulties are likely to threaten the economic outlook, such as the resurgence of political instability, the sharp increase in public spending, delays in implementing structural reforms, and the dependence on rain-dependent agriculture threatened by adverse weather conditions.

The budget deficit remains an issue for policymakers, so fiscal consolidation is a key strategic focus of the 2018-2021 National Development Plan, which garnered USD 1.7 billion in donor commitments at a May 2018 conference in Brussels. Disciplined implementation of the SOE reform programme, lower domestic borrowing and a stronger commitment to administrative austerity measures would reduce the deficit. Overall, policies should focus on improving the efficiency of service provision using limited state resources.

Solving the problems of electricity and water shortages remains a key political priority. Access to electricity is 47% nationally, but only 13% in remote provinces. Only 60 MW of the total 106 MW installed capacity is available, and in 2016 transmission and distribution network losses reached 26%. The unreliability of the electricity supply also has an impact on the availability of water in Greater Banjul, exacerbating the problem of limited access to running water.

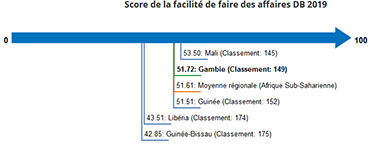

1.4 The business environment / Ease of Doing Business

Note: The Ease of Doing Business score tracks the gap that each economy has from the best performance for each indicator, across all economies measured by Doing Business since 2005. An economy's ease of doing business score is presented on a scale of 0 to 100, where 0 represents the lowest performance and 100 represents the best performance. The ease of doing business ranking ranges from 1 to 190.

Source : http://www.doingbusiness.org

- Benin (capital: Porto-Novo)

- Burkina Faso (capital: Ouagadougou)

- Cape-Verde (capital: Praia)

- Ivory Coast (capital: Abidjan)

- Gambia (capital: Banjul)

- Ghana (capital: Accra)

- Guinea (capital: Conakry)

- Guinea Bissau (capital: Bissau)

- Liberia (capital: Monrovia)

- Niger (capital: Niamey)

- Nigeria (capital: Abuja)

- Senegal (capital: Dakar)

- Sierra Leone (capital: Freetown)

- Togo (capital: Lomé)

Sectors of activity

Agro-industry

Health

Energy