1.1 Political and geographical characteristics of Sierra Leone

Following the American Revolution, a colony was established in 1787 and Sierra Leone became a preferred destination for the resettlement of the black faithful who had been resettled in Novo Scola. After the slave trade was abolished in 1807, British crews delivered thousands of Africans from an illegal slave ship to Sierra Leone, Freetown in particular. The country gained independence in 1961. The president is elected directly by an absolute majority, popular vote in 2 rounds if necessary for a 5-year term (eligible for a second term). The last election took place in April 2018 and Julius Maada BIO was elected as President of the Republic.

- Area : 71,740 km2

- Population growth : 2.4%

- Population : 6,312,212 (July 2018)

- Urban population : 42.1% (2018)

- Density : 89 inhabitants/km2

- Official language : English

Sierra Leone is part of ECOWAS, the West African Monetary Zone with Cape Verde, Gambia, Ghana, Guinea Conakry and Nigeria. The country is a member of the Mano River Union along with Ivory Coast, Liberia and Guinea.

1.2 Macroeconomic framework

| Classement Doing Business | 163th/190 |

| Human development index | 184th/189 |

| Note CPIA (policy and institutional assessment) | 3,2 World Bank classification |

| GDP per capita (2017) | 572$ |

| Growth rates | 3,7%(2017 est.) |

| Inflation | 18,2%(2017 est.) |

Sources : https://www.cia.gov – http://documents.worldbank.org

Main exports

Iron, diamond, rutile, cocoa, coffee, fish

Human Development and Infrastructure

59 years old

Life experience (2018)

70,2%

Poverty line population

62,6%

(total population) Access to water

66,7/1000

(2018 est.) Infant mortality

34

Distribution of family income GNI coefficient

5%

Access to electricity

28,8%

Malnutrition (total population)

48,1%

Adult literacy

102%

Cell phone access

1.3 Sierra Leone economic performance and outlook

Macroeconomic performance

Real GDP growth of about 3.5 percent in 2018 is lower than in 2017 (5.8 percent) due to weaker-than-expected iron ore extractions, lower prices since 2014, and the closure of the main mining company, Shandong Iron and Steel Company, in 2017.

The fiscal deficit widened to –7.7% of GDP in 2018 from –6.8% in 2017, mainly due to a lack of revenue mobilization and budget overruns related to elections. Public debt has risen significantly, from 55.9% of GDP in 2016 to 60.8% in 2017. To remedy this situation, new measures have been taken: the adoption of a single treasury account and the reduction of customs duty waivers and exemptions.

The Central Bank has proactively implemented a tight monetary policy and limited its support for public financing. However, weaknesses in internal control continue to threaten the accumulation of foreign exchange reserves and macroeconomic stability. Since 2016, the exchange rate has depreciated by more than 30% and in 2018, inflation remains high, at around 13.9%.

In 2018, the current account deficit widened to –16.9% from –13% in 2017, due to higher imports of consumer goods and weak export performance. Exports are mainly made up of unprocessed products: gold, diamonds, iron ore, and cashew nuts, while imports mainly include rice, oil, and machinery. Real GDP growth is expected to reach 5.6% in 2019 and 5.8% in 2020, driven by higher private agricultural and mining investment, in a context of business climate reforms.

Outlook: positive and negative factors

The growth outlook is accompanied by macroeconomic imbalances. The fiscal deficit, financed in part by the accumulation of payment arrears, is expected to persist and poses a significant risk to economic growth, due to liquidity compression and the rising cost of investment projects. The government is considering more prudent fiscal and monetary policies and is demonstrating strong political will to improve.

The deficit is partly due to increased public investment in infrastructure, such as roads and energy, which in the medium to long term is expected to boost economic activity.

However, persistent macroeconomic imbalances could threaten economic growth, including the fiscal deficit and the increase in the current account deficit to –18.4 percent in 2019 and –20.8 percent in 2020, caused by weak growth in agricultural and mining exports. Other risk factors include public debt, which is still on the rise, and commodity price shocks. In general, the country is extremely vulnerable to external shocks due to its dependence on commodity exports.

The government has undertaken several reforms. The Mining Law should improve the tax regime for mining companies, allow for better supervision and increase revenues. Two policies, launched in 2018, aim to ensure financial sustainability in the energy sector, particularly in the implementation of the following objectives: universal access to electricity and increasing the energy mix.

Finally, the country's Roadmap for National Agricultural Transformation (2018) aims to increase the country's rice self-sufficiency, livestock development and crop diversification, and to do so has identified four strategic axes: improving the policy environment, promoting women and youth in agriculture, implementing private sector-led mechanization, and sustainable management of biodiversity.

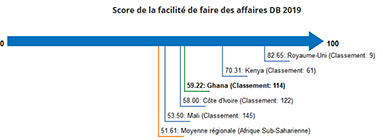

1.4 The business environment / Ease of Doing Business

Note: The Ease of Doing Business score tracks the deviation of each economy from the best regulatory performance for each indicator, across all economies measured by Doing Business since 2005. An economy's Ease of Doing Business score is presented on a scale from 0 to 100, where 0 represents the lowest performance and 100 represents the best performance. The Ease of Doing Business ranking ranges from 1 to 190.

Source : http://www.doingbusiness.org

- Benin (capital: Porto-Novo)

- Burkina Faso (capital: Ouagadougou)

- Cape-Verde (capital: Praia)

- Ivory Coast (capital: Abidjan)

- Gambia (capital: Banjul)

- Ghana (capital: Accra)

- Guinea (capital: Conakry)

- Guinea Bissau (capital: Bissau)

- Liberia (capital: Monrovia)

- Niger (capital: Niamey)

- Nigeria (capital: Abuja)

- Senegal (capital: Dakar)

- Sierra Leone (capital: Freetown)

- Togo (capital: Lomé)

Sectors of activity

Agro-industry

Health

Energy