1.1 Political and geographical characteristics of Nigeria

British influence and control over what was to become Nigeria, Africa's most populous country, developed over the course of the 19th century. After the Second World War, several constitutions granted Nigeria considerable autonomy. Following independence, politics was marked by coup d'état and mainly by military rule until the death of the head of state in 1998, which enabled a political transition. In 1999, a new constitution was adopted and a peaceful transition to civilian rule was successfully completed. Under the Nigerian constitution, the president is directly elected by popular vote with a qualified majority of 25% of the votes cast in 24 of Nigeria's 36 states. The president is elected for a 4-year term, renewable for a second term.

- Area : 923,768 km2

- Population growth : 2,54%

- Population : 203,452,502 (July 2018)

- Urban population : 50,3% (2018)

- Density : 220 inhabitants/km2

- Official language : English

A member of the West African Monetary Zone, Nigeria is also part of the Community of West African States, along with Benin, Burkina Faso, Cape Verde, Ivory Coast, Gambia, Ghana, Guinea, Guinea Bissau, Liberia, Mali, Niger, Senegal, Sierra Leone and Togo.

1.2 Macroeconomic framework

| Classement Doing Business | 146th/190 |

| Human development index | 157th/189 |

| Note CPIA (policy and institutional assessment) | 3,2 World Bank classification |

| GDP per capita (2017) | 1848$ |

| Growth rates | 0,8%(2017 est.) |

| Inflation | 16,5%(2017 est.) |

Sources : https://www.cia.gov – http://documents.worldbank.org

Main exports

Petroleum and petroleum products 95%, cocoa, rubber (2012)

Human Development and Infrastructure

59,3 years old

Life experience (2018)

70%

Poverty line population

68,5%

(total population) Access to water

63,3/1000

(2018 est.) Infant mortality

48,8

Distribution of family income GNI coefficient

45%

Access to electricity

8,5%

Malnutrition (total population)

59,6%

Adult literacy

76%

Cell phone access

1.3 Nigeria economic performance and outlook

Macroeconomic performance

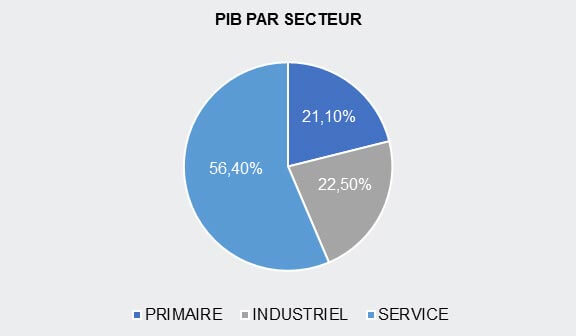

The growing importance of services has supported economic growth. The sector accounts for around half of GDP, with 10% coming from oil and 22% from agriculture. Real GDP growth was estimated at 1.9% in 2018, reflecting a recovery in services and industry, particularly mining, quarrying and manufacturing. The recovery benefited from greater availability of foreign currency. Growth in agriculture was lackluster, partly due to clashes between farmers and herders, flooding in key regions of the middle belt and the ongoing insurgency in the northeast.

On the macroeconomic front, Parliament's delay in approving the 2018 budget affected implementation and increased fiscal uncertainty by pushing the bulk of spending into the second half of the year. But thanks to oil revenues, a value-added tax on luxury goods and a tax amnesty, the budget deficit narrowed in 2018, financed mainly by public debt.

In June 2018, outstanding public debt stood at $73.2 billion, up from $71.0 billion in 2017, or 17.5% of GDP. Despite this increase, Nigeria's risk of debt distress remained moderate. In November 2018, the government issued US$2.9 billion in Eurobonds, reflecting its new public debt management strategy that prioritizes external debt to mitigate the high financing costs of domestic borrowing. In addition, relatively good oil revenues helped consolidate the current account surplus, estimated at 3.7%, and improve the terms of trade by around 13% in 2018 alone.

Real GDP is expected to grow by 2.3% in 2019 and 2.4% in 2020, as implementation of the economic stimulus and growth plan gathers pace. However, the fall in oil prices from the end of 2018, combined with the production cut imposed by the Organization of the Petroleum Exporting Countries, poses a downside risk to the economic outlook. Parliamentary approval of the N8.83 trillion “continuity budget” in 2019 could also be delayed due to the presidential elections scheduled for February 2019.

Outlook: positive and negative factors

The outlook depends on the pace of implementation of the Economic Recovery and Growth Plan, which anchors Nigeria's industrialization by creating industrial clusters and commodity processing zones to give companies a competitive edge through access to raw materials, skilled labor, technologies and materials.

The power sector reform programme, if implemented effectively, could attract private investment. It targets an operational capacity of 10 GW by 2020. But Nigeria needs to reorient its federal budget, currently dominated by recurrent expenditure, towards more capital expenditure and savings accumulation to support social spending.

The federal government has made progress on institutional and governance reforms, including the implementation of the Integrated Financial Management and Information System and the Integrated Personnel and Salary Information System. The adoption of the 2017 Law on Secured Transactions in Movable Property institutionalized and expanded collateral coverage to stimulate lending to small and medium-sized enterprises. Although Nigeria's debt-to-GDP ratio is relatively low. Financial prudence remains necessary to avoid a debt trap, especially if global interest rates start to rise. Therefore, a contraction of new external debt will need to balance spending needs with the ability to improve the economy's competitiveness and boost growth.

Nigeria accounts for nearly 20% of the continent's GDP and about 75% of the West African economy. Despite this dominance, its exports to the rest of Africa are estimated at 12.7 per cent, and only 3.7 per cent of total trade is within the Economic Community of West African States. Nigeria has not yet ratified the African Continental Free Trade Area Agreement, pending the outcome of extensive consultations with captains of industry and other countries.

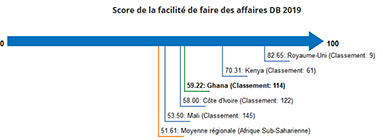

1.4 The business environment / Ease of Doing Business

Note: The Ease of Doing Business score tracks the deviation of each economy from the best regulatory performance for each indicator, across all economies measured by Doing Business since 2005. An economy's Ease of Doing Business score is presented on a scale from 0 to 100, where 0 represents the lowest performance and 100 represents the best performance. The Ease of Doing Business ranking ranges from 1 to 190.

Source : http://www.doingbusiness.org

- Benin (capital: Porto-Novo)

- Burkina Faso (capital: Ouagadougou)

- Cape-Verde (capital: Praia)

- Ivory Coast (capital: Abidjan)

- Gambia (capital: Banjul)

- Ghana (capital: Accra)

- Guinea (capital: Conakry)

- Guinea Bissau (capital: Bissau)

- Liberia (capital: Monrovia)

- Niger (capital: Niamey)

- Nigeria (capital: Abuja)

- Senegal (capital: Dakar)

- Sierra Leone (capital: Freetown)

- Togo (capital: Lomé)

Sectors of activity

Agro-industry

Health

Energy